Nigerians have withdrawn a staggering ₦15.98 trillion in cash over the past months as the Central Bank of Nigeria (CBN) gradually steers the country back toward traditional cash transactions and ATM usage. The surge comes amid the apex bank’s recalibration of its cashless policy, signaling a renewed effort to balance digital finance adoption with the realities of Nigeria’s largely informal economy.

According to recent data from the Nigeria Inter-Bank Settlement System (NIBSS), ATM withdrawals have risen significantly since early 2024, marking a reversal from last year’s sharp decline during the controversial cash redesign and withdrawal limit policy. Analysts say the CBN’s shift reflects a pragmatic approach — easing restrictions to restore liquidity and consumer confidence after months of cash shortages that disrupted businesses nationwide.

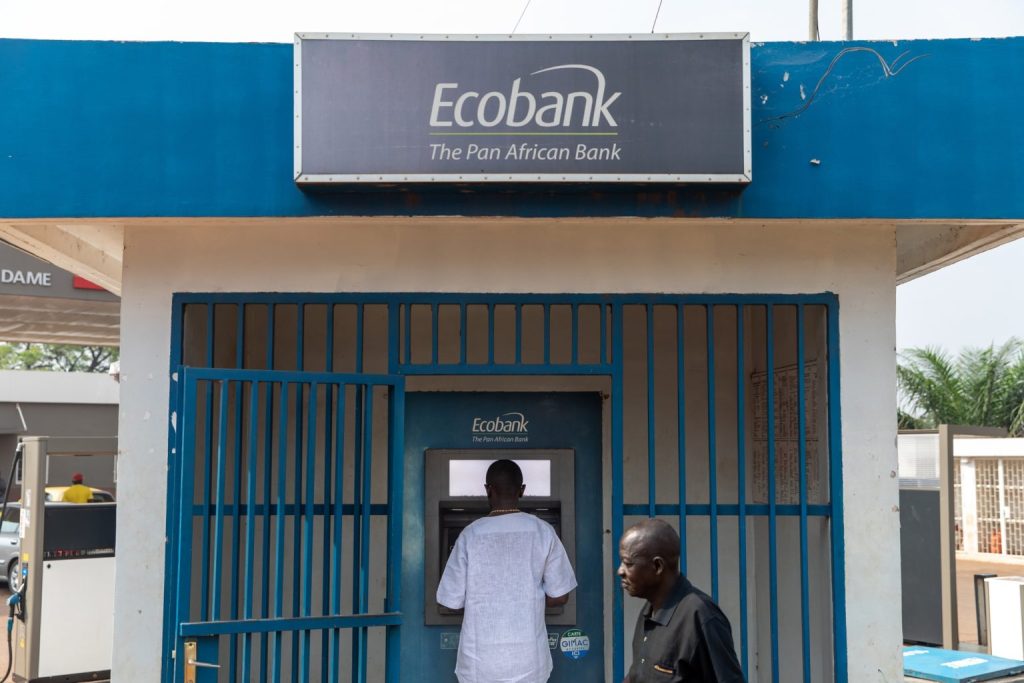

The ₦15.98 trillion figure underscores how deeply Nigerians still rely on physical cash for daily transactions, particularly in rural and informal sectors where digital penetration remains low. Despite the growth of fintech and mobile money services, many Nigerians prefer the immediacy and reliability of cash, especially given challenges such as poor network coverage, transaction failures, and limited trust in digital platforms.

A CBN source noted that the policy realignment aims to “stabilize financial accessibility across all segments of society,” ensuring both digital and physical cash systems work in harmony. Commercial banks have since responded by restocking ATMs, expanding cash points, and improving withdrawal limits to meet rising demand.

Economists warn, however, that the resurgence of cash could slow progress toward a fully digital economy. They urge the CBN to continue investing in financial infrastructure while addressing barriers that discourage digital payment adoption.

As Nigeria finds its footing between cash and digital money, the ₦15.98 trillion withdrawal trend highlights a simple truth: while technology is reshaping finance, cash remains king — at least for now.

Leave a Reply