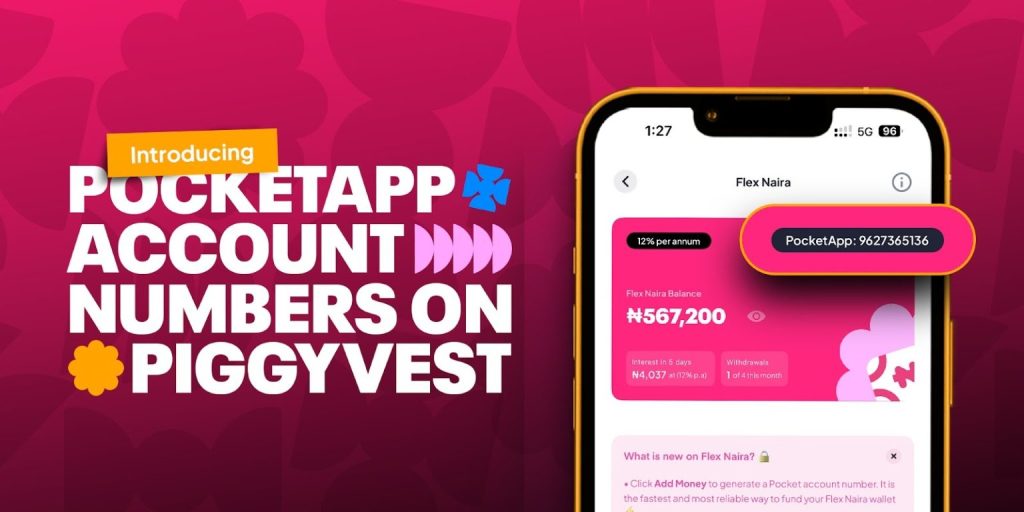

Piggyvest, one of Nigeria’s largest digital savings and investment platforms, has announced the launch of its new in-house payment system, fully powered by its sister product, PocketApp, marking a major step in the company’s long-term strategy to build a complete financial ecosystem. The move solidifies Piggyvest’s shift from relying on external payment processors to operating a vertically integrated system that enhances speed, reliability, and cost efficiency for its millions of users.

For years, Piggyvest has grown into a household name by helping Nigerians automate savings, manage investments, and build financial discipline. However, the platform often had to navigate delays, failed transactions, and high processing charges from third-party payment partners. By transitioning to a proprietary system facilitated through PocketApp—its social commerce and payments subsidiary—Piggyvest aims to eliminate these bottlenecks and give users a smoother financial experience.

The new payment infrastructure enables faster deposits, seamless withdrawals, instant wallet-to-wallet transfers, and real-time transaction monitoring. PocketApp’s payment engine is built on an upgraded architecture that supports high transaction volumes, improved fraud detection, and better reconciliation tools, ensuring that users’ funds move more predictably and securely.

According to Piggytech leadership, integrating payments internally is both a technological milestone and a strategic business decision. It positions the company to compete more directly with established fintechs offering end-to-end financial services, while maintaining full control over the customer journey. The move also reduces operational costs, which can be reinvested into product innovation and more user-friendly features across Piggyvest and PocketApp.

Industry analysts say the development reinforces a growing trend in Nigeria’s fintech space: consolidation and vertical integration. As user demands evolve and transaction volumes surge, fintechs are increasingly building internal capabilities to minimize reliance on external infrastructure.

For users, the shift promises more reliable savings automation, fewer failed debits, and faster access to funds—critical features for individuals trying to manage daily finances and long-term goals. PocketApp, on its part, stands to benefit from increased activity and visibility as Piggyvest channels millions of transactions through its rails.

By completing this ecosystem play, Piggyvest is not only strengthening its competitive edge but also signaling its intention to become a more robust, full-service financial powerhouse in Africa’s rapidly evolving digital economy.

Leave a Reply