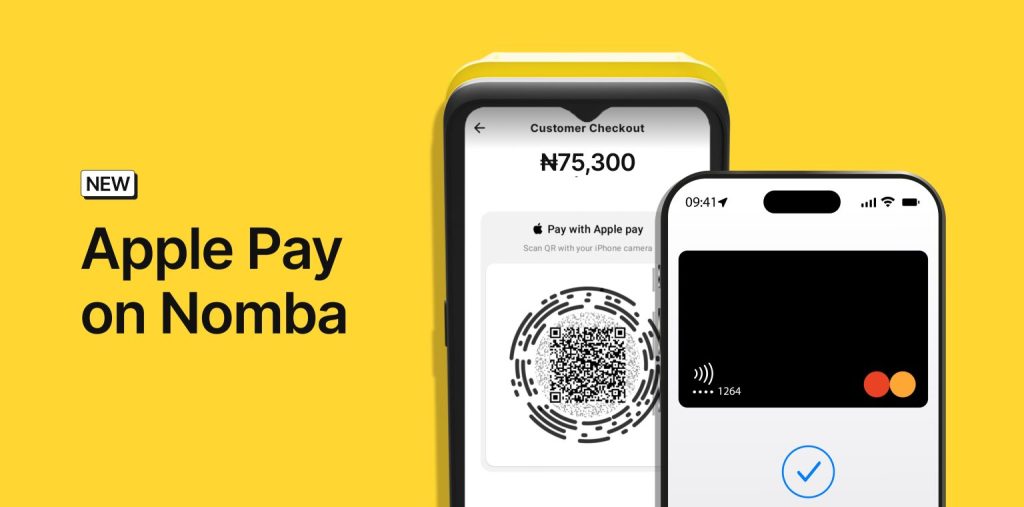

Nomba, a fast-growing payments platform in Nigeria, has integrated Apple Pay into its ecosystem, enabling Nigerian businesses to accept global payments more easily. This move comes as more local merchants seek seamless ways to transact with international customers and tap into global e-commerce opportunities.

For years, Nigerian businesses have faced challenges in accepting foreign payments due to limited payment gateways, high transaction fees, and currency restrictions. By integrating Apple Pay, Nomba now allows merchants to receive payments from millions of Apple users worldwide, reducing friction in cross-border transactions. Customers can pay directly from their iPhones, iPads, or Macs using a secure and convenient method, enhancing the shopping experience and potentially increasing sales for Nigerian businesses.

Nomba’s platform focuses on empowering businesses of all sizes—from startups to established enterprises—with tools to manage payments, invoices, and financial reporting. The addition of Apple Pay complements existing payment methods such as card payments, bank transfers, and local mobile wallets. It also positions Nomba as a forward-thinking payments provider that is attentive to the needs of a digitally savvy business community.

This development reflects broader trends in Nigeria’s fintech ecosystem, where startups are increasingly enabling local merchants to participate in the global digital economy. With more consumers shopping online internationally, access to trusted global payment methods like Apple Pay is becoming a competitive necessity.

For Nigerian businesses, the integration offers both convenience and credibility. It signals to international customers that Nigerian merchants are equipped with modern, reliable payment options, helping to boost trust and reduce cart abandonment.

By expanding its payment capabilities, Nomba is not just simplifying transactions—it is helping Nigerian businesses scale globally. As more platforms follow suit, the barriers to global commerce for African businesses are gradually eroding, opening up new opportunities for growth, digital trade, and international market access.

Leave a Reply