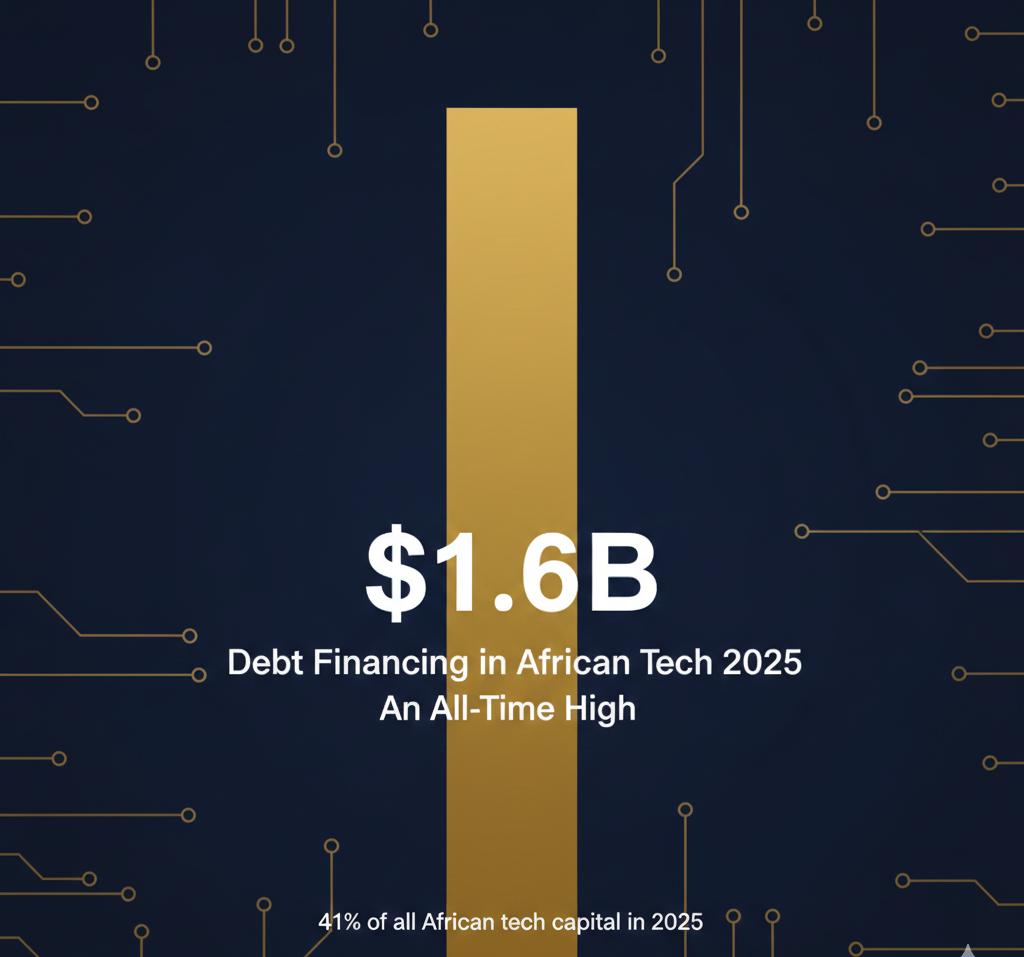

Something is quietly changing in African tech—and if you’re only watching equity headlines, you might miss it. In 2025 alone, startups across the continent raised $1.64 billion in debt financing. That’s a 63 percent jump from $1.01 billion in 2024. Even more telling? There were 108 debt deals this year, up 40 percent. Debt now accounts for 41 percent of all capital deployed into African tech, compared to just 17 percent in 2019. This isn’t just growth. It’s a structural shift.

For years, equity was the headline act. Big valuation rounds. Big dilution. Big celebrations. But founders are becoming more intentional. Debt allows growth-stage startups to raise serious capital without giving away ownership. It signals maturity. It means companies now have predictable revenue, stronger balance sheets, and models solid enough to service loans. In other words, African startups are no longer just chasing capital—they’re engineering it.

Take Wave in Senegal. The fintech giant raised $137 million in debt led by Rand Merchant Bank. And here’s the key: they didn’t choose debt because they couldn’t raise equity. They chose it because it was smarter. When a company deliberately opts for non-dilutive capital, it sends a powerful message about confidence and long-term strategy.

The capital flow also tells a regional story. Kenya led the continent with $498 million, representing 33 percent of all debt raised. Egypt followed with $246 million, up 73 percent year-on-year. Nigeria saw $160 million, marking a 132 percent increase. Senegal posted $139 million, largely driven by Wave. These aren’t random spikes. They reflect ecosystems that are deepening financially, not just expanding in volume.

Sector-wise, fintech continues to dominate, pulling in $716 million—44 percent of all debt capital deployed. Cleantech raised $627 million and stands out as the only sector where debt actually exceeded equity. That’s a strong signal. Investors are increasingly comfortable backing infrastructure-heavy, revenue-generating businesses with structured financing instead of ownership stakes.

The $1.6 billion milestone isn’t just a record. It’s proof that African tech is evolving. Debt is no longer a backup plan—it’s becoming a strategic lever. And if this pace continues, the next phase of the ecosystem won’t just be about how much startups raise, but how intelligently they structure the money they take.

Leave a Reply